Man, diving into the Sam Bankman-Fried trial feels like stepping into a crypto thriller. Picture this: a courtroom drama mirroring the rollercoaster of the crypto world. Sam, the once golden boy of FTX, now caught in the crossfire of a criminal fraud trial.

|

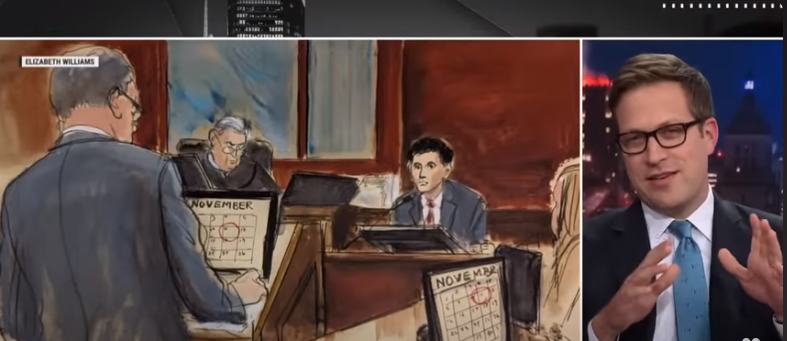

He looks like a mess’: Sam Bankman-Fried takes the stand in his criminal fraud trial |

The showdown with the prosecutor, Danielle Sassoon, is pure tension. Did Sam know about the billions in customer money going rogue before FTX went down? It's like a poker game where he's holding his cards tight, denying any knowledge of the financial apocalypse looming over his empire.

The stakes here are no joke. Seven counts of fraud, conspiracy, and money laundering—talk about a legal maelstrom. FTX's colossal collapse left customers high and dry, and if Sam gets hit with the guilty verdict, it's basically game over for him.

Picture this symphony of accusations. Three close associates spilled the beans, pointing fingers at Sam as the mastermind behind the mega-fraud. Betrayal, intrigue, and a courtroom drama that rivals any Hollywood plot.

Let's rewind to the glory days of FTX. Changpeng Zhao, the big shot from Binance, sells his stake, triggering a financial domino effect that takes FTX down. The courtroom is like a time machine, unraveling the complexities of the crypto industry and questioning its moral compass.

Now, Sam's on the stand, playing a risky game. His attempt to assert good faith in his business decisions clashes with the prosecution's relentless grilling. It's a gambit that could either make or break him.

Tuesday's cross-examination is like a deep dive into the events leading to FTX's implosion. The prosecutor questions the truth, probing Sam about Alameda owing billions in customer money. His selective memory and cryptic responses add a layer of mystery to this legal circus.

Now, let's dissect this trial using the PREP framework—Present, Relate, Explain, and Persuade. Sam's denial of giving directives? That's like the captain of a sinking ship claiming ignorance about the leaks. It doesn't quite add up.

The courtroom is a theater stage, witnessing a clash of narratives. Sam's public image as a crypto wizard collides with the portrayal of a scheming fraudster. Trust shattered, alliances broken, and fortunes lost—it's a story that hits you right in the gut.

As the prosecutor weaves through the cryptic timeline of FTX's collapse, the enigma deepens. Sam's inability to recall key events raises the question: genuine forgetfulness or a slick maneuver to dodge the blame?

The prosecution's relentless pursuit of truth is convincing. Sam's alleged favors to Bahamian officials and contradictory statements cast a shadow over his credibility. The jury has a maze of deception to navigate to uncover the truth.

As the trial inches toward its climax with closing statements on Wednesday, the crypto world holds its breath. The verdict could reshape not only Sam Bankman-Fried's fate but also how we see an entire industry. It's a thriller, alright.

FAQs

Did Sam Bankman-Fried know about the misappropriation of customer money?

Sam Bankman-Fried vehemently denies any knowledge of the misappropriation of customer money until shortly before FTX's collapse. His testimony emphasizes his lack of awareness of the alleged fraudulent activities.

Did he instruct employees against spending FTX customer money on investments?

During cross-examination, Sam Bankman-Fried struggled to recall giving specific directions to employees regarding the spending of FTX customer money. He stated that he doesn't remember issuing any directives related to investments, pricey real estate, or other expenditures.

Who authorized the use of FTX customer money for extravagant spending?

In his testimony, Sam Bankman-Fried couldn't identify any employees who might have authorized the use of FTX customer money for extravagant spending. He repeatedly stated that he doesn't recall giving any explicit directions in this regard.

Comments

Post a Comment