In the kaleidoscopic world of tech startups, 2023 marks the year when the vibrant bubble, engorged by the Federal Reserve’s easy-money policies, finally popped. The aftermath of this financial reconfiguration is not unlike the scattered pieces of a once-monumental mosaic—tech startups that once navigated through an ocean of capital at premium valuations, have found themselves stranded in a desert of fiscal reality.

Cheap Money Era Ends

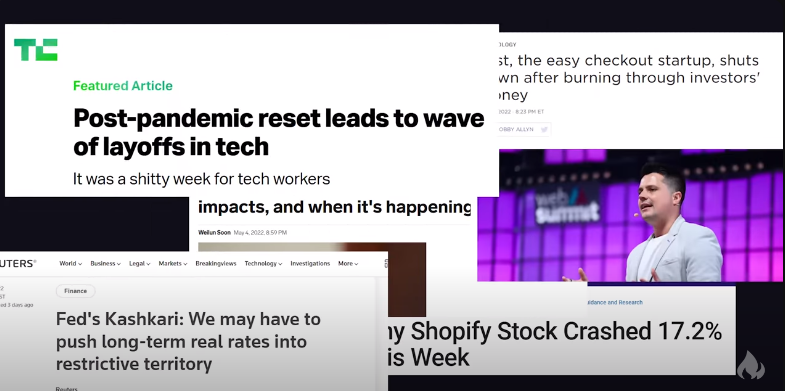

As tech entrepreneurs adjust their pitch decks from Silicon Valley to Wall Street, it’s clear the economic landscape has shifted dramatically. For years, startups thrived under the benevolent auspices of the Fed’s near-zero interest rate policy, a fiscal posture initiated in response to the 2008 financial crisis and extended as a defibrillator for the economic flatline induced by the Covid-19 pandemic. Low interest rates translated into a deluge of cheap cash, making riskier assets, like startup investments, painfully irresistible to yield-chasing investors.

High-Profile Failures Mount

Wave after wave of funding bolstered valuations without the scrutiny typically bestowed on profitability or sustainable business models, a testament to the frenzied optimism that bubbled across the tech sector. But as the Fed adjusted its benchmark rate upwards in response to persistent inflation and the whims of economic cycles, the tide rapidly rescinded, leaving many startups gasping for capital. Emblematic of this are companies such as WeWork and Bird, which, despite prior acclaim and billions of funding, succumbed to bankruptcy in 2023. Similarly, Hopin and Clubhouse, once darlings of the pandemic era’s social distancing economy, have seen their luster dim into non-existence.

Linking Causes to Consequences

The lesson here is as old as market economies themselves—sustainability matters. These startups collectively gambled on a future that heavily relied on continuous investor enthusiasm without the need for traditional financial robustness. As investors retreat, licking their wounds, and refocus on more enduring qualities such as revenue and profitability, these erstwhile high-flyers face corporate existential crises. Fundamentally, the ‘capital spigot’ that was flipped open has been tightened, potentially to a trickle, redirecting the riverbed of startup progression.

Recognizing the Fallen Unicorns

What this trend heralds for the tech landscape is the inevitable acknowledgment that not all startups are destined for unicorn status—and that fiscal prudence cannot remain forever in the shadow of aggressive expansion and unproven business models. Moreover, this constriction may not just be a temporary season; rather, it could represent a climactic shift wherein only the fittest—those who leverage ingenuity to align income with expenditure—survive and thrive.

In detailing the casualties, the story of the precipitated decline of these companies serves as a stark reminder of the ephemeral nature of businesses that fail to adapt to the foundational demands of profitability.

Fundamentals Regain Favor

Yet, even amidst this fiscal wreckage, optimism for the tech industry is not entirely misplaced. Venture capitalists like Jeff Richards of GGV Capital recognize that even in a post-easy-money era, well-managed companies with strong fundamentals and a clear path to profitability are still in a position to blossom.

The Silver Lining in AI and Cloud Computing

A shining example is Nvidia, which saw its value more than triple in 2023. Its success is due to the relentless demand for its processors, which are crucial for the burgeoning field of artificial intelligence. Similarly, Meta enjoyed a considerable resurgence thanks to its strategic pivots. These examples underline that even in the face of general market downturns, sectors driven by genuine innovation and demand continue to offer rays of hope.

Good Old Profitability

The plain truth is that in these success stories, basic economic principles are being respected. Businesses thrive on profitability, and those bending their growth strategies to accommodate this age-old tenet are finding firm footing. Such companies act as beacons, guiding the way through the now stormier seas of tech investment.

Asset to Reality

The juxtaposition between these thriving entities and the faded supernovas of the startup scene underscores a return to valuing sound, financial housekeeping over the smoke and mirrors of overvaluation and excessive burn rates. In the sober light of 2023, the markets are beckoning a more mature, measured approach to tech investments.

Growing from the Ashes

2023 has been a crucible year, burning away the chaff to reveal the substantive potential within the tech sector. As venture capitalists once again tighten their belts and focus on creating and nurturing truly innovative companies, the demise of the ZIRP 'unicorns' may well be remembered as an inflection point—a time when the industry recalibrated and set a course for a future marked by greater discernment and foresight.

What we are witnessing is not merely a burst bubble but a foundational restructuring of the tech startup ecosystem—out of the ash pile of overvalued, profitless companies emerges a phoenix of financial practicality and responsible innovation. This renaissance promises not only to redefine success in tech but also to inoculate the sector against similar future excesses. As industry participants navigate this new terrain, lessons gleaned from the bubble’s burst will drives a more robust, enduring mode of technological progress.

F.A.Q.

Question 1.

Q.: What caused the startup bubble to burst in 2023?

A.: The startup bubble burst in 2023 was primarily fueled by a shift in Federal Reserve policy. After years of near-zero interest rates which made capital easily accessible for tech startups, the Fed increased rates to combat inflation. This shift led to a decrease in risk appetite from investors, halting the flow of cheap money and exposing startups that were reliant on continued investment rather than operational profitability, leading to high-profile bankruptcies.

Question 2.

Q.: Which notable startups declared bankruptcy in 2023 as a result of the bubble burst?

A.: In 2023, some highly publicized bankruptcies within the tech startup sector included WeWork, known for coworking spaces, and Bird, the electric scooter company. Other companies that once thrived during the pandemic, such as video conferencing platform Hopin and social audio app Clubhouse, faded significantly or became obsolete as their business models could no longer sustain without hefty investment rounds.

Question 3.

Q.: How did the COVID-19 pandemic impact tech startups before the burst of the bubble?

A.: The COVID-19 pandemic initially led to a surge of investments in tech startups, as the demand for remote work solutions, online entertainment, and education technologies skyrocketed. Companies that facilitated remote collaboration or provided digital services to consumers in lockdown saw massive valuation increases and heightened investor interest, creating an investment bubble that inflated rapidly through 2021.

Question 4.

Q.: Are there any sectors within the tech industry that have continued to flourish despite the burst?

A.: Yes, even amidst the downturn caused by the burst, sectors such as artificial intelligence (AI) and cloud computing have continued to see growth. Companies like Nvidia have experienced a significant surge in value due to the demand for advanced AI processors. Likewise, Meta Platforms (formerly known as Facebook) saw a substantial recovery attributed to its AI investments and the implementation of cost-saving measures.

Question 5.

Q.: What is expected for the tech startup landscape moving forward after the 2023 bubble burst?

A.: Moving forward, the tech startup landscape is likely to refocus on fundamental business principles such as profitability and sustainable growth. Investors are expected to exercise more caution, supporting companies with solid business models rather than speculative ventures. Venture capitalists predict that the IPO market for tech startups could see a revival in the second half of 2024, where a new crop of companies, possibly those emerging from current challenges, could succeed. This reset serves as a fresh starting point for tech startups with resilient and well-adapted strategies for the post-bubble market.

Comments

Post a Comment