Introduction: Unlocking the Strategy

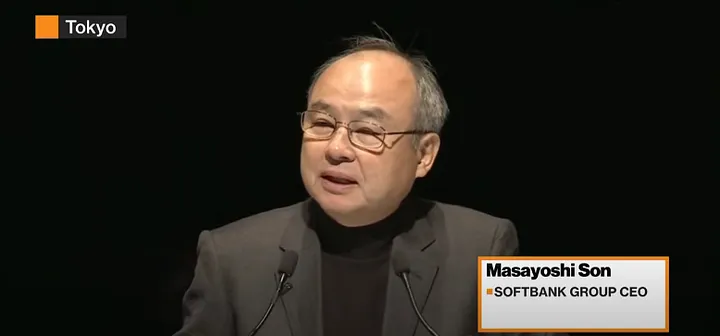

In the fast-paced world of finance and technology, decisions regarding share prices during a company's debut on the stock market can have far-reaching consequences. One such intriguing case is that of Masayoshi Son, the visionary leader behind SoftBank, who opted for a share price of $51 instead of the potentially higher $52 per share. This choice raises essential questions about valuation, strategy, and investor confidence. In this article, we will explore the intricacies of this decision and the broader implications it carries.

|

The Significance of Share Price in Debut

Setting the stage for our exploration, it's crucial to understand why share price matters significantly during a company's debut on the stock market. Beyond the numerical value, share price carries a narrative that can influence investor perception and market dynamics. A carefully chosen share price can set the tone for a successful debut, and Masayoshi Son was acutely aware of this.

Decoding Masayoshi Son's Ambitious Share Price

Masayoshi Son's decision to offer SoftBank shares at $51 each, as opposed to $52, was not a random choice but a calculated move. It reflected his ambition and strategic thinking. By pricing the shares at $51, he aimed to strike a delicate balance between attracting investors and ensuring a smooth market entry.

Valuation: The Core of the Matter

At the heart of SoftBank's share price decision lies the concept of valuation. Valuation in the corporate context refers to determining the economic value of a company. It is a pivotal aspect of decision-making, whether it's related to mergers, acquisitions, or, in this case, an IPO. For SoftBank, it was not just about setting a share price; it was about growing into that valuation.

Semiconductors: The Foundation of SoftBank's Story

To understand SoftBank's valuation strategy better, we must delve into their core narrative. SoftBank strategically places semiconductors at the center of their story. Semiconductors, the fundamental building blocks of modern technology, are integrated into nearly every processor in the tech world. This strategic focus on semiconductors shapes their value proposition and sets them apart in the industry.

Exploring SoftBank's Expansive Addressable Market

One key aspect contributing to SoftBank's valuation is its expansive addressable market. The addressable market represents the potential customer base that a company can target. In the case of SoftBank, this market is substantial, given their involvement in various tech sectors. It's estimated to be roughly 100 times their historical reported earnings.

Historical Earnings: A Glimpse into Growth Potential

Looking at SoftBank's historical earnings provides valuable insights into their growth potential. Investors often scrutinize a company's past performance to gauge its future prospects. SoftBank's track record is a testament to its ability to generate revenue, but they must continue to grow sales and profits to align with their valuation.

Investor Confidence and the Strategy to Lower Valuation Multiples

Investor confidence is a critical factor for any company aiming to lower its valuation multiples. SoftBank has successfully cultivated investor belief in their growth story. Investors expect the company to increase sales and profits significantly, which, in turn, will reduce the valuation multiple. This strategy underscores the importance of meeting or exceeding investor expectations.

Conclusion: A Strategic Share Price Decision

In conclusion, Masayoshi Son's decision to set SoftBank's share price at $51 instead of $52 was not merely about numbers; it was a strategic move designed to ensure a smooth market debut. Valuation, with semiconductors as the core narrative, plays a pivotal role in SoftBank's journey. Their expansive addressable market and historical earnings reflect their growth potential, while investor confidence and strategic planning drive their efforts to lower valuation multiples.

As SoftBank continues its mission in the ever-evolving tech landscape, this decision remains a testament to the intricacies of valuation and strategy in the world of finance and technology.

Note: To support my Medium journey, please subscribe below.⬇️

My Earl’s Newsletter Substack is committed to providing free access to all readers. We do not impose paywalls on any of our articles. However, you can show your support by subscribing to our newsletter https://earlcotten.substack.com. My best contents will be written on SUBSTACK🙏feel free to clap👏, comment 💬, click the❤️ button on the post so that more people can discover it on. - Read More 👈

Comments

Post a Comment