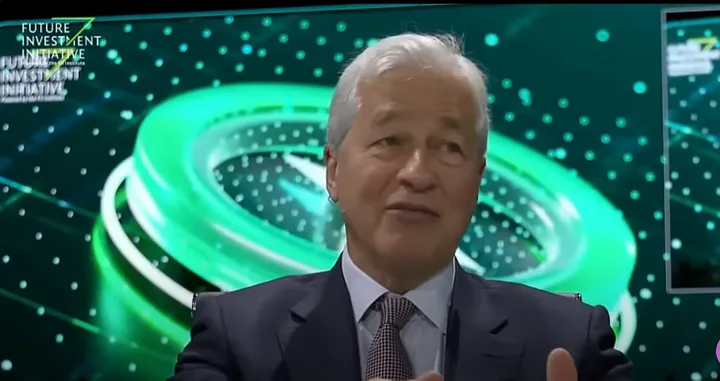

In the mystical realm of finance, where fortunes ebb and flow like tides, executives and board members waltz with the shares of their empires. Picture Jamie Dimon, the seasoned maestro of JPMorgan Chase & Co., stepping into the limelight with a revelation that sends tremors through the market.

|

| Jamie Dimon's Stock Analysis: Insider Secrets, Tax Strategies, and JPMorgan's Future Revealed! |

It's a crisp Friday, and the stage is set with a securities filing, pulling back the curtain on Dimon's plan to part ways with a substantial chunk—around 12%—of his familial JPMorgan stock portfolio. This disclosure not only applies pressure on JPMorgan shares and the Dow Jones Industrial Average but also paints a vivid canvas, highlighting the paramount importance of scrutinizing trades executed by the custodians of corporate realms.

Dimon's Dance with Destiny

Dimon, the helmsman steering JPMorgan for almost two decades, orchestrates these trades through a predetermined plan—a well-practiced enchantment to ward off accusations of insider trading. What makes this performance a spellbinding spectacle is that it marks the first instance where Dimon is parting ways with JPMorgan shares for reasons transcending the realm of mere option exercises.

The motivations behind these planned sales are a nuanced dance between tax planning and personal wealth diversification, according to the bank. These reasons, while commonplace, add a layer of intrigue to the narrative. JPMorgan, quick to assure investors, underscores Dimon's unyielding confidence in the bank's robust prospects and dismisses any whispers of these transactions being entwined with succession plans—a common refrain when CEOs approach the twilight of their careers.

Navigating the maze of insider transactions is akin to deciphering an ancient scroll. When luminaries like Dimon make moves in the market, the ripples can be as unpredictable as the wind.

Dimon's Serenade to the Market

Dimon's history of stock transactions reads like a captivating saga. Cast your mind back to 2016 when global economic fears sent shockwaves through the stock market, and JPMorgan found itself tossed in a tempest. The bank's shares, like a ship in a storm, plummeted nearly 20%, mirroring the broader decline in the S&P 500.

Yet, in the eye of this financial hurricane, Dimon composed a symphony that would echo through Wall Street. On February 11, 2016, as uncertainty cast its shadow, Dimon made a bold declaration by acquiring 500,000 shares of JPMorgan—a staggering $26 million ballet. This act of confidence, a choreography of conviction in the face of retreat, shifted the tides.

The timing of Dimon's purchase aligned with a pivotal moment in the market. The revelation of his substantial buy-in on that fateful day acted as a catalyst, sparking a remarkable turnaround. Jim Cramer, the maestro of market wisdom, christened it "The Jamie Dimon Bottom." The result? JPMorgan ascended by 30% that year, and the S&P 500 concluded more than 9% higher—a colossal crescendo attributed, in part, to Dimon's strategic play.

The Enigma of Executive Stock Sales

While Dimon's planned sales in 2023 may not necessarily be red flags, interpreting such transactions requires an appreciation for the nuances. Executive stock sales, especially those of high-profile figures like Dimon, are enigmatic tales that demand careful consideration.

The looming question is whether these transactions, designed for tax planning and personal wealth diversification, hold deeper significance. Do they foreshadow a shifting landscape within JPMorgan or narrate a broader commentary on the financial sector? Dimon's reassurances about the bank's strong prospects add a layer of complexity to the narrative, leaving investors to traverse a labyrinth of information.

Unveiling the Tale: A Storyteller's Craft

In unraveling the tapestry of Jamie Dimon's stock odyssey, we delve into the art of storytelling—a narrative woven with threads of Parse, Reveal, Engage, and Propel. Each element of this saga serves as a guide to peel back the layers of complexity surrounding executive transactions.

The Unveiling of Secrets

Our narrative commences with the unraveling of secrets. Parsing the details of Dimon's planned sales involves disentangling the threads of information to reveal the underlying narrative. What forces drive these transactions? Tax planning and personal wealth diversification offer a glimpse into Dimon's motives, but do they tell the full story?

The Dance of Revelation

With the secrets parsed, the story unfolds with the dance of revelation. What hidden motivations or signals are embedded in Dimon's actions? This stage seeks to expose the intricate details that might elude the casual observer, shedding light on the deeper currents at play.

Engaging with the Enchantment

As the layers reveal themselves, the narrative shifts to engaging with the enchantment. How should investors interpret Dimon's moves? What implications do these transactions hold for the broader market and the financial sector? Engaging with the information requires a thoughtful analysis, considering both the microcosm of JPMorgan and the macrocosm of the financial landscape.

Propelling into the Unknown

The final act of our saga involves propelling into the unknown. What does the future hold for JPMorgan and other entities in the wake of Dimon's planned sales? How should investors position themselves in response to this intricate dance of financial dynamics? Propelling into the unknown requires a forward-looking perspective, anticipating the ripples that might emanate from these transactions.

In conclusion, Jamie Dimon's stock odyssey offers a captivating narrative, rich with nuances and complexities. Through the art of storytelling, we navigate the labyrinth of information, gaining a deeper understanding of the implications woven into the fabric of executive transactions. As the financial world continues its perpetual dance, decoding the moves of key players like Dimon becomes not just a task but an art—one that requires a keen eye, strategic thinking, and an appreciation for the ever-evolving tapestry of the market.

FAQs

What is the reason behind Jamie Dimon's planned stock sales?

Jamie Dimon's planned stock sales are driven by tax planning and personal wealth diversification reasons. This marks the first instance where the CEO is offloading shares for non-technical reasons, such as exercising options.

How does the predetermined plan protect executives from insider trading accusations?

The predetermined plan serves as a protective measure against insider trading accusations. Executives at publicly traded companies, including Jamie Dimon, use these plans to establish a pre-set trading schedule, minimizing the risk of legal implications.

Why is this the first time Jamie Dimon is selling JPMorgan shares for non-technical reasons?

Jamie Dimon's decision to sell JPMorgan shares for tax planning and personal wealth diversification represents a strategic financial move. It deviates from his previous stock transactions, which were often tied to technical reasons like exercising options.

What percentage of JPMorgan stock owned by Dimon is part of the planned sales?

The planned sales account for approximately 12% of the JPMorgan stock owned by Jamie Dimon and his family. This substantial portion is being strategically sold for the aforementioned financial planning purposes.

Are tax planning and personal wealth diversification common reasons for executives to sell stock?

Yes, tax planning and personal wealth diversification are common reasons for executives, including Jamie Dimon, to sell stock in their respective firms. These financial strategies help executives manage their wealth and navigate the complexities of the stock market.

Comments

Post a Comment