So, the IRS just dropped some big news, unveiling the new income tax brackets and standard deductions for 2024. This move is all about keeping up with inflation and shaking things up in the tax world. Let's dive into the nitty-gritty and break down the key changes every taxpayer should be clued in on.

|

| There is a common misunderstanding about how tax brackets work in the US |

Key Points:

Income Tax Brackets Boosted:

- The IRS is giving the income brackets a facelift, set for the 2024 tax year and returns filed in 2025.

- For 2024, if your taxable income is above $609,350 or you're a power couple pulling in $731,200, get ready for the top tax rate of 37%.

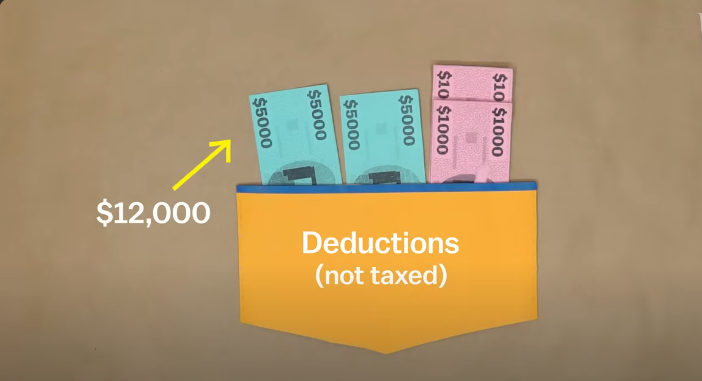

Standard Deduction Increase:

- In 2024, the standard deduction is getting a boost, hitting $29,200 for married couples filing jointly, up from $27,700 in 2023.

- Single filers can now snag $14,600, a bump from the previous $13,850.

Adjustments for Other Tax Provisions:

- The IRS isn't just messing with income brackets; they're tweaking various other tax plays.

- Standouts include changes in the alternative minimum tax, estate tax exemption, and a boost in the earned income tax credit.

Higher Standard Deduction Optimization

When it comes to sorting out your taxes, the standard deduction takes center stage in figuring out your taxable income. For the upcoming tax year, couples filing jointly can now claim a standard deduction of $29,200, up from $27,700 last year. Single filers aren't left behind, with their standard deduction rising to $14,600 from the previous $13,850.

Adjustments for Other Tax Provisions

The IRS isn't only shaking things up with income tax brackets; they're also playing around with other tax provisions. These changes affect a bunch of areas, from the alternative minimum tax to estate tax exemption and beyond.

Alternative Minimum Tax (AMT)

For those raking in the big bucks, the alternative minimum tax is getting a makeover in 2024. Understanding the ins and outs of AMT is crucial for those navigating the complex world of tax planning.

Estate Tax Exemption

Wealthy families, take note – the estate tax exemption is going through some changes. Staying in the loop about these adjustments is crucial for crafting effective estate planning strategies.

Earned Income Tax Credit (EITC)

Folks with moderate incomes are catching a break with a higher earned income tax credit, maxing out at $7,830. This adjustment recognizes the financial dynamics across different income brackets.

Flexible Spending Accounts (FSA)

Employees now have the green light to toss $3,200 into health flexible spending accounts, offering more flexibility in managing healthcare-related expenses.

Planning Ahead

As taxpayers gear up for the upcoming tax year, navigating these changes strategically is key. Understanding how adjustments in income tax brackets, standard deductions, and other provisions impact your financial planning is essential. Staying on top of these changes ensures that individuals and families can make the most of their financial well-being.

In a nutshell, the IRS's announcement of new income tax brackets and standard deductions for 2024 sets the stage for a nuanced approach to tax planning. By wrapping your head around these adjustments, you can make informed decisions that align with your financial goals. As we step into the new tax year, it's time to arm ourselves with the knowledge to navigate the ever-evolving landscape of tax regulations.

F.A.Q.

Question 1.

Q.: What changes did the IRS announce regarding federal income tax brackets for 2024?

A.: The IRS recently unveiled adjustments to the federal income tax brackets for the year 2024. This move is in response to inflation, with the income thresholds for each bracket receiving an update.

Question 2.

Q.: Can you provide details about the top tax rate for the year 2024?

A.: Certainly. For the tax year 2024, the top tax rate is set at 37%. This rate applies to individuals with taxable income exceeding $609,350 and married couples filing jointly with an income surpassing $731,200.

Question 3.

Q.: What modifications were made to the standard deduction for 2024?

A.: In 2024, the standard deduction sees an increase. For married couples filing jointly, it rises to $29,200, up from $27,700 in 2023. Single filers can now claim $14,600, compared to the previous $13,850.

Question 4.

Q.: Are there other notable changes in tax provisions besides income brackets and standard deductions?

A.: Indeed, the IRS didn't stop at adjusting income brackets. There are significant changes in various other tax provisions, including the alternative minimum tax, estate tax exemption, and figures related to the earned income tax credit.

Question 5.

Q.: What is the maximum amount for the earned income tax credit in 2024?

A.: In 2024, the earned income tax credit sees an increase, reaching a maximum of $7,830. This adjustment is beneficial for low- to moderate-income filers, acknowledging the financial dynamics across different income brackets.

Comments

Post a Comment