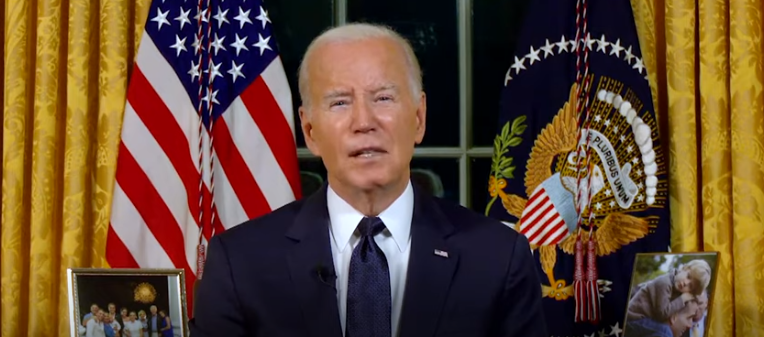

In the domain of oil trading, a new figure unexpectedly emerged as an influential player — none other than the President of the United States, Joe Biden. The strategic release of oil from America’s petroleum reserves not only showcased presidential intervention in curtailing soaring oil prices but also reveled in astute financial savvy that reaped significant monetary gains for the Energy Department. As the world keenly observes, questions mount regarding the administration’s next steps in what many on Wall Street consider an enviable trade.

The stage was set when geopolitical tension reached a fever pitch with Russia’s invasion of Ukraine. The global market recoiled, sending oil prices through the roof and straining economies worldwide. Amidst this crisis, President Biden took a decisive step. By authorizing the largest-ever release from the Strategic Petroleum Reserve (SPR), the administration aimed to stabilize markets and offer relief to consumers facing escalating fuel prices.

As the oil prices receded, a multifaceted plan was unfurled by the administration to replenish the depleted reserves. With prices now more favorable, the Energy Department undertook the task of buying back oil, leveraging the dip in prices to achieve considerable savings. The overarching goal was clear: to restore the SPR while securing a financial advantage.

The process of replenishing the SPR has been methodical. Initially, the Energy Department retrieved oil lent to refiners, returned with interest. This move reclaimed some of the reserves and established a precedent for profit. Furthermore, Congress annulled previously scheduled sales, allowing an additional $12.5 billion to flow into the Energy Department for further purchases.

However, the most challenging aspect proved to be buying on the open market, a rarity in recent times. After a failed initial attempt, the administration refined its approach by adjusting the target price and altering contracts to mitigate supplier risk. This adjustment allowed the Energy Department to jumpstart its purchasing plan, locking in contracts at strategic price points.

President Biden’s actions have had a palpable impact. Around 13.8 million barrels of crude have been acquired at an average price of $75.63 per barrel — a stark contrast to the previous year’s sale price of $95 per barrel. This translates to nearly $270 million in theoretical savings. As of now, with the current oil prices staying below the administration’s maximum price, the strategy continues to work in favor of the federal coffers.

While the market remains fluid, the Biden administration has showcased a deft understanding of the oil trading game. Through strategic releases and prudent buybacks, the SPR not only functions as a buffer against supply shocks but also emerges as a tool for financial gains. This savvy maneuvering has added an unlikely title to the President’s repertoire — Oil Trader Extraordinaire.

Still, complexities persist. The administration must navigate the operational limitations of the storage facilities and delicately time the market to maximize the financial benefit. The most recent contracts are set for deliveries stretching into March and beyond. This long-range planning suggests a growing confidence in the strategy and the agility to adapt to market dynamics.

The Biden administration’s oil trade management is revolutionary, striking a balance between market intervention and fiscal responsibility. This proactive approach stands to convert the United States’ strategic reserves into pillars of market stability and national security, reinforcing the nation’s stature as an energy superpower.

In evaluating these developments, one can’t help but admire the fortitude and finesse with which the administration has engaged the global oil markets. As analysts and traders alike scrutinize the federal government’s next moves, it’s evident that the strategic implications extend beyond mere financials — they signal America’s resolute commitment to leverage its resources for broader economic and geopolitical leverage.

President Biden’s gambit may have started as a response to a crisis, but it has blossomed into a masterclass in strategic reserve management — a testament to the administration’s ability to navigate the high-stakes world of energy economics with an unexpected and shrewd prowess in the oil trading arena.

F.A.Q.

Question 1.

Q.: What prompted President Biden to become an active player in the crude oil market?

A.: President Biden’s decision was primarily a response to the surging oil prices following Russia’s invasion of Ukraine. As a strategic measure, he authorized the unprecedented release of oil from America’s petroleum reserves, essentially stepping into the oil trading arena to stabilize prices and alleviate the economic pressure on consumers.

Question 2.

Q.: How has the U.S. Strategic Petroleum Reserve (SPR) affected oil prices?

A.: The SPR release aimed to temper the rising oil costs, and it proved effective; oil prices have since sputtered, dipping below previous highs. This reduction in oil prices provided a window of opportunity for the U.S. to replenish its stockpiles at a lower cost, adding a significant buffer to the national reserves.

Question 3.

Q.: What strategies has the Biden administration employed to manage the Strategic Petroleum Reserve?

A.: The administration has employed a three-pronged strategy to manage the SPR effectively. It has reclaimed oil from refiners, recovered a premium on these returns, and has been working on large-scale purchases from the open market. The latter proved challenging but adjustments in strategy, such as raising the target purchase price, have yielded successful contract negotiations for future deliveries.

Question 4.

Q.: Is it true that the Strategic Petroleum Reserve is now at a 40-year low, and what are the plans for replenishing it?

A.: Yes, following President Biden’s largest-ever release, the SPR was reduced to a 40-year low. Currently, the administration’s plans include strategically purchasing oil back during times when the market prices are deemed advantageous. They aim to restore the reserves without frivolous expenditures, thus safeguarding taxpayer’s interests.

Question 5.

Q.: How might current and future geopolitical events influence the Biden administration’s oil strategies?

A.: Geopolitical events, such as international conflicts, can significantly affect global oil prices and supply routes. The Biden administration must remain vigilant and adaptable in its strategy, potentially tightening or loosening reserve release and replenishment tactics in response to such events to secure the nation’s economic interests and maintain market stability.

Question 6.

Q.: What role do the storage limitations of the Strategic Petroleum Reserve play in the oil purchasing strategy?

A.: Storage limitations are a critical factor in the purchasing strategy. The SPR facilities can only receive a certain volume of oil per month, and not while they are releasing reserves or undergoing maintenance. This limitation requires meticulous strategic planning to ensure the SPR’s capacity is not outstripped by the pace of oil repurchases.

Question 7.

Q.: Could America’s handling of the Strategic Petroleum Reserve influence its position as an energy superpower?

A.: Absolutely. The strategic management of the SPR not only impacts the domestic oil prices but also reflects on America’s ability to influence global oil markets. By demonstrating a capacity to stabilize its market and invest fiscally, the U.S. can assert greater influence over global oil trade dynamics and bolster its standing as an energy leader.

Comments

Post a Comment